Home Owners Insurance Introduction

Home Owner Insurance is one of the most significant financial investments many Americans make in their lifetime. With the pride of owning a home also comes the responsibility of protecting it from unforeseen events that could lead to devastating financial losses. Homeowners insurance serves as a crucial safety net, offering protection for your home, personal property, and liability. This comprehensive guide delves into the details of homeowners insurance in the United States, examining its types, benefits, coverage options, cost factors, and more.

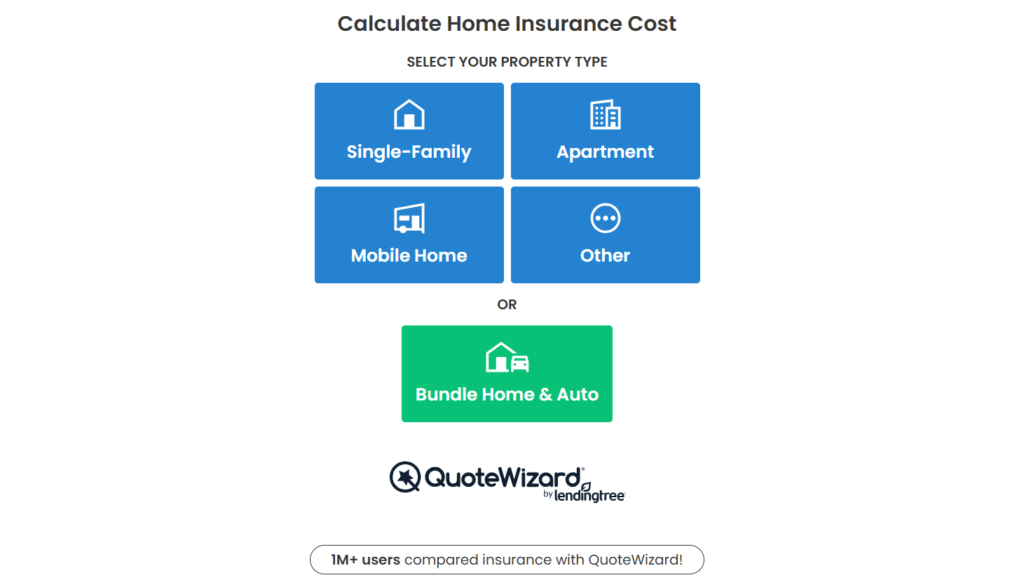

Calculate Home Insurance Cost

Click Here

What is Homeowners Insurance?

Home Owner Insurance is a policy that provides financial protection against various types of damage to your home, as well as liability protection in case someone is injured on your property. It typically covers the structure of the house, personal property inside, and can also offer liability coverage if someone is injured on the property or if you inadvertently cause damage to someone else’s property.

Types of Homeowners Insurance Policies

Home Owner Insurance there are several different types of homeowners insurance policies available in the U.S., each offering varying levels of coverage and protection. The most common types are:

1. HO-1: Basic Form Home Owner Insurance

Home Owner Insurance this is the most basic homeowners insurance policy, offering minimal coverage. It typically covers damages caused by fire, lightning, windstorms, hail, and vandalism. However, it doesn’t cover personal property or liability, and it is not commonly used today.

2. HO-2: Broad Form Home Owner Insurance

The HO-2 Home Owner Insurance policy offers broader coverage than HO-1 and includes damage from additional perils such as falling objects, snow, ice, and freezing pipes. It provides coverage for both the structure and personal property, though it still does not cover everything.

3. HO-3: Special Form Home Owner Insurance

The HO-3 Home Owner Insurance policy is the most widely used homeowners insurance policy in the U.S. It provides coverage for the structure of the home against all types of damage, except for those specifically excluded (such as floods or earthquakes). Personal property is typically covered on a named-perils basis (only for specific risks listed in the policy).

4. HO-4: Renters Insurance Home Owner Insurance

While this is technically not a Home Owner Insurance policy, HO-4 is designed for renters and provides coverage for personal property and liability. Renters are not responsible for the building itself, but this policy protects their belongings and covers liabilities.

5. HO-5: Comprehensive Form Home Owner Insurance

This Home Owner Insurance policy provides the most extensive coverage, covering both the home structure and personal property on an open-perils basis. This means it covers all types of damage unless specifically excluded by the policy. It is the most comprehensive form of homeowners insurance available but is also the most expensive.

6. HO-6: Condo Insurance Home Owner Insurance

HO-6 Home Owner Insurance is designed for condo owners. It covers personal property inside the condo, and in some cases, it provides coverage for the structure, depending on the condo association’s master policy.

7. HO-7 and HO-8: Mobile/Manufactured Home Owner Insurance

These Home Owner Insurance policies are tailored for owners of mobile or manufactured homes. They offer similar coverage to the HO-3 but are designed to address the unique risks associated with mobile homes, including depreciation concerns.

2025 Best Rated Home Warranty Companies

GET A PLAN

Key Components of Homeowners Insurance

Understanding the primary components of Home Owner Insurance is essential to ensure adequate coverage. The typical homeowners insurance policy includes several types of coverage:

1. Dwelling Coverage (Coverage A)

This portion of the Home Owner Insurance policy covers the structure of the home itself, including walls, roof, foundation, and any attached structures like garages or decks. If your home is damaged by a covered peril, this coverage will help pay for repairs or rebuilding costs.

2. Personal Property Coverage (Coverage C)

Personal property coverage protects your belongings, such as furniture, electronics, clothing, and appliances. This protection applies if your property is damaged or stolen due to a covered event. However, valuable items like jewelry, art, and collectibles often require additional coverage or an endorsement.

3. Liability Coverage (Coverage E)

Home Owner Insurance Liability coverage protects you in case someone is injured on your property or if you cause damage to someone else’s property. For instance, if a guest slips and falls on your property, this coverage can help with medical expenses and legal costs if they decide to sue.

4. Medical Payments Coverage (Coverage F)

Home Owner Insurance this coverage helps pay for medical expenses if someone is injured on your property, regardless of who is at fault. Unlike liability coverage, this does not cover lawsuits but instead helps cover immediate medical bills.

5. Additional Living Expenses (ALE) Coverage

If your home becomes uninhabitable due to a covered event, ALE helps pay for temporary living expenses like hotel bills, food, and other necessary costs. This Home Owner Insurance coverage ensures that you are not financially burdened while your home is being repaired.

OUR EXPERIENCE IS YOUR ADVANTAGE

GET NOW

Common Perils Covered by Homeowners Insurance

Home Owner Insurance policies generally provide protection against the following common perils:

- Fire or Lightning

- Windstorm or Hail

- Theft

- Vandalism

- Explosion

- Falling Objects (e.g., trees)

- Riot or Civil Commotion

- Damage from Ice, Snow, or Sleet

- Water Damage from Plumbing Leaks

- Electrical Surges

- Aircraft or Vehicles Collisions

It’s essential to review your Home Owner Insurance policy to understand which specific perils are covered and any exclusions that may apply.

Exclusions in Homeowners Insurance

While homeowners insurance provides extensive protection, there are specific exclusions you should be aware of. These typically include:

- Flooding: Most standard homeowners insurance policies do not cover damage caused by flooding. For flood protection, homeowners must purchase a separate flood insurance policy.

- Earthquakes: Earthquake damage is typically excluded and requires a separate policy or endorsement.

- Maintenance Issues: Homeowners insurance does not cover damage resulting from poor maintenance or neglect. For example, if a roof deteriorates due to lack of maintenance, that damage may not be covered.

- Pest Infestation: Damage caused by termites or rodents is typically not covered.

- Intentional Damage: If the homeowner intentionally damages their property or causes injury, it will not be covered by insurance.

Protect The Place Where Memories Are Made

GET NOW

Benefits of Homeowners Insurance

The primary benefit of Home Owner Insurance is the financial protection it offers in case of damage or loss. However, it provides several other advantages:

1. Financial Protection

Without Home Owner Insurance, a significant loss due to fire, theft, or other damage could leave homeowners with steep repair costs. Insurance helps cover the expenses, reducing the financial burden.

2. Liability Protection

If someone is injured on your property or if you accidentally cause damage to another person’s property, liability coverage can help protect you from legal and medical costs.

3. Peace of Mind

Knowing that your home and belongings are protected offers peace of mind. Homeowners insurance helps you recover from unexpected losses and move forward with minimal disruption.

4. Mortgage Requirement

For most homebuyers who finance their homes with a mortgage, lenders typically require homeowners insurance to protect the property against damage. Insurance ensures the lender’s investment is protected in case of disaster.

5. Additional Living Expenses Coverage

If your home is rendered uninhabitable, the additional living expenses coverage ensures you can afford temporary housing, meals, and other necessities until your home is restored.

6. Protection for Personal Property

Home Owner Insurance covers personal property in the event of a covered peril, ensuring that valuable possessions like electronics, jewelry, and furniture are protected.

Cost of Homeowners Insurance

The cost of Home Owner Insurance can vary significantly based on several factors, including the location of your home, its value, the coverage limits, and your personal circumstances. Key factors affecting the cost of homeowners insurance include:

- Location of the Home: Homes in areas prone to natural disasters (floods, hurricanes, tornadoes, earthquakes) may incur higher premiums.

- Home’s Value and Age: Older homes or homes with higher replacement costs typically cost more to insure.

- Deductible Amount: Choosing a higher deductible (the amount you pay out-of-pocket before insurance coverage kicks in) may lower your premium.

- Coverage Limits: The amount of coverage you choose for your home, personal property, and liability will directly affect your premium.

- Claims History: If you have a history of filing claims, insurers may raise your premium, as they consider you a higher risk.

How to Choose the Right Homeowners Insurance

When selecting Home Owner Insurance, consider the following:

- Evaluate Your Home’s Value: Ensure that your policy’s coverage limits reflect the current value of your home and belongings.

- Review the Policy Terms: Make sure to understand the perils covered, exclusions, and limits on personal property.

- Shop Around: Get quotes from multiple insurance providers to compare coverage options and premiums.

- Consider Additional Coverage: If you own high-value items like jewelry or antiques, consider purchasing additional coverage or endorsements.

Conclusion

Home Owner Insurance is an essential part of protecting your home, belongings, and financial well-being. It offers invaluable peace of mind, knowing that in the event of damage, theft, or accidents, you are covered. By understanding the different types of policies, the coverage they offer, and the factors that impact cost, you can make an informed decision when selecting a homeowners insurance policy that meets your needs. Whether you’re a first-time homebuyer or an experienced homeowner, having the right homeowners insurance is key to safeguarding your investment and protecting your future.

FAQs About Mortgage holders Protection in the USA

What is mortgage holders protection?

Mortgage holders insurance is a contract that gives monetary security to mortgage holders in case of harm or misfortune to their property and assets. It ordinarily covers the design of the home, individual assets, risk for wounds on your property, and extra everyday costs assuming that the home becomes appalling.

What does property holders protection cover?

Mortgage holders protection by and large covers:

Abiding Inclusion: Security for the actual construction of the home.

Individual Property Inclusion: Insurance for possessions inside the home, like furnishings, hardware, and apparel.

Obligation Inclusion: Security in the event that somebody is harmed on your property or you make harm another person’s property.

Loss of Purpose Inclusion: Helps pay for impermanent everyday costs on the off chance that your home becomes dreadful because of a covered occasion.

Clinical Installments: Covers minor clinical expenses for visitors harmed on your property.

What isn’t covered by mortgage holders protection?

Normal prohibitions include:

Flooding: Harm from floods as a rule requires separate flood protection.

Seismic tremors: Quake harm isn’t covered except if you add different tremor inclusion.

Mileage: Property holders protection for the most part doesn’t cover harm from maturing or disregard, for example, shape or establishment issues.

War and Atomic Mishaps: Harm from war, psychological oppression, or atomic perils is normally avoided.

How much property holders protection do I want?

How much inclusion you want relies upon factors like the worth of your home, the expense to remake it, the worth of your own possessions, and your responsibility chances. An ordinary rule is to guarantee your residence inclusion is adequate to modify your home in the event that it’s totally obliterated, and your own property inclusion ought to represent the worth of your effects.

What kinds of mortgage holders insurance contracts are accessible?

The most well-known sorts of property holders protection are:

HO-1: Essential inclusion for explicit risks.

HO-2: Wide inclusion for additional risks.

HO-3: Extraordinary inclusion that covers most hazards, aside from those unequivocally prohibited (the most well-known type).

HO-4: Leaseholders protection (covers individual property and responsibility, yet not the structure).

HO-5: Exhaustive inclusion for both the abode and individual property.

HO-6: Apartment suite protection.

HO-7: Trailer protection.

HO-8: Inclusion for more established homes.

What amount does mortgage holders protection cost?

The expense of mortgage holders protection differs in view of elements like the worth of your home, area, how much inclusion you pick, your deductible, and your cases history. By and large, property holders protection in the U.S. costs somewhere in the range of $800 and $2,000 each year, however it very well may be higher in regions inclined to cataclysmic events.

What variables influence my mortgage holders insurance installment?

A few elements can impact your charges, including:

Home Estimation: The size, age, and state of your home.

Area: Homes in regions inclined to debacles (e.g., storms, floods, seismic tremors) may have higher charges.

Deductible Sum: A higher deductible by and large outcomes in a lower premium.

Claims History: Mortgage holders with a background marked by continuous cases might confront higher rates.

Wellbeing Highlights: Homes with security frameworks, smoke alarms, and heat proof materials might meet all requirements for limits.

Financial assessment: In certain states, back up plans utilize your FICO rating to decide your premium.

What is a deductible in property holders protection?

A deductible is how much cash you should pay personal before your insurance contract kicks in to cover a case. For instance, on the off chance that you have a $1,000 deductible and record a case for $5,000 in punitive fees, you’ll pay the first $1,000, and your protection will cover the excess $4,000.

Might I at any point document a case for harm from a catastrophic event?

Property holders protection ordinarily covers harm from specific cataclysmic events, like fire, windstorms, and hail. Be that as it may, inclusion for occasions like flooding or quakes for the most part requires separate strategies. Actually take a look at your strategy to see which debacles are covered and whether extra inclusion is required for your particular area.

Is property holders protection legally necessary?

Mortgage holders insurance isn’t legally necessary in the U.S., however on the off chance that you have a home loan, your bank will probably expect you to have a property holders protection contract to safeguard their interest in the property. Indeed, even without a home loan, mortgage holders protection is enthusiastically prescribed to safeguard your property and things.

How might I bring down my property holders insurance payment?

To bring down your premium, consider:

Expanding your deductible.

Introducing wellbeing and security highlights, for example, smoke alarms, robber cautions, or heat proof materials.

Packaging your property holders insurance with different contracts, similar to collision protection, to get limits.

Keeping a decent FICO rating (if material in your state).

Looking and contrasting statements from numerous back up plans.

What is obligation inclusion in property holders protection?

Obligation inclusion in mortgage holders protection safeguards you on the off chance that somebody is harmed on your property or on the other hand assuming you coincidentally harm another person’s property. For instance, on the off chance that a visitor slips and falls in your home, responsibility inclusion would assist with covering their clinical costs and any legitimate charges assuming you are sued.

Do I really want separate flood protection?

Mortgage holders insurance contracts regularly don’t cover flood harm. On the off chance that you live in a flood-inclined region, it’s enthusiastically prescribed to buy separate flood protection through the Public Flood Protection Program (NFIP) or a confidential guarantor.

Does mortgage holders protection cover locally established organizations?

Mortgage holders protection commonly doesn’t cover business exercises directed from your home. In the event that you maintain a business from home, you might have to add a rider or buy a different business insurance contract to safeguard your hardware, stock, or responsibility.

How would it be a good idea for me to respond on the off chance that I want to record a case?

In the event that you really want to document a case, follow these means:

Contact your insurance agency as quickly as time permits to report the harm.

Archive the harm with photographs or recordings.

Save receipts for any crisis fixes or transitory lodging.

Help out the cases agent during the evaluation interaction.

Follow up to guarantee your case is handled promptly.

Might mortgage holders protection at any point cover harm from a home remodel?

Property holders protection commonly gives restricted inclusion during redesigns. It’s essential to advise your back up plan about any significant remodels to suitably change your inclusion. Assuming you’re rolling out huge improvements to your home, you might require extra inclusion for the development time frame or for any unique materials or project workers included.

What is the contrast between substitution cost and genuine money esteem?

Substitution Cost: This inclusion pays to supplant your harmed property with new things of comparative kind and quality, without calculating in deterioration.

Genuine Money Worth: This inclusion pays for the harmed property less devaluation, significance you’ll be repaid for the ongoing worth of the thing, not what it would cost to supplant it.

How frequently would it be a good idea for me to survey my property holders insurance contract?

It’s smart to survey your mortgage holders insurance contract every year or after any significant life altering events, like redesigns, buying important things, or a huge change in your home’s estimation. This guarantees your inclusion is modern and satisfactory for your necessities.

Might I at any point switch property holders protection suppliers?

Indeed, you can switch property holders protection suppliers. In any case, it’s critical to really look at the details of your ongoing arrangement and guarantee you have no punishments for dropping early. Look at statements from changed guarantors and ensure your new strategy begins prior to dropping your old one to keep away from a slip by in inclusion.

What is an underwriting in property holders protection?

A support is an expansion to a standard mortgage holders insurance contract that changes the inclusion. Supports might be utilized to increment or diminishing inclusion cutoff points or add insurance for explicit things, like gems, workmanship, or significant assortments.